Trading commodity futures and options involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge and financial resources.

For more info on the grains as well as customizable charts, quotes, news, commentary and more try a FREE no risk 30-day trial of Markethead.com.

SOYBEANS/SOYBEAN MEAL/SOYBEAN OIL

-From DOW JONES NEWSWIRE by Andrew Johnson Jr.

- “The U.S. Department of Agriculture estimated U.S. 2011-12 soybean ending

stocks at 210 million bushels, down 40 million from its estimate in April. The

USDA raised its export estimate by 25 million bushels and raised the crush by

15 million.” - “The government lowered its estimate of 2011-12 world soybean ending stocks to

53.2 million tons from 55.5 million in April. Brazil’s production was lowered

by 1 million tons to 65 million, while Argentina was lowered by 2.5 million to

42.5 million tons.” - “The USDA estimated U.S. 2012-13 soybean ending stocks at 145 million bushels,

below the average analyst estimate of 170 million.” - “U.S. new crop end stocks of 145 million are supportive as it doesn’t leave a

lot of wiggle room. Tighter beginning supplies for the 2012-13 crop year raise

the need for a perfect growing season.”

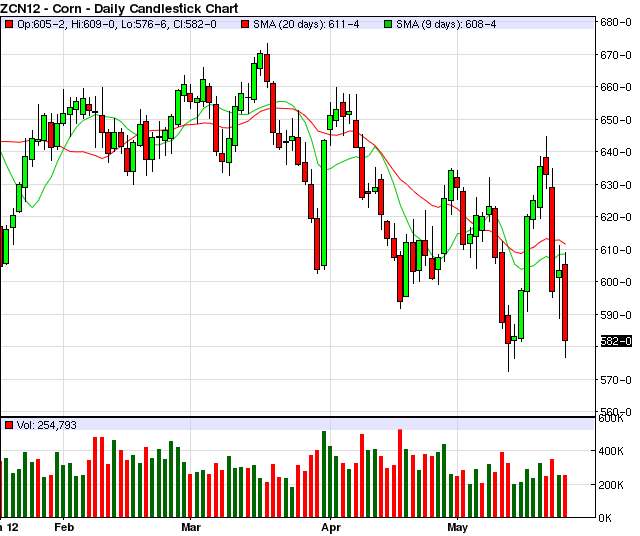

CORN

-From DOW JONES NEWSWIRE by Ian Berry

- “The report projected 2011-12 ending stocks, or stockpiles left at the end of

August, at 851 million bushels, up from an April estimate of 801 million

bushels and shocking analysts who on average expected stockpiles of 758 million

bushels. None of the 19 analysts surveyed by Dow Jones Newswires had expected

an increase.” - “The USDA also projected 2012-13 ending stocks will balloon to 1.881 billion

bushels, above the average analyst estimate of 1.704 billion.” - “The higher-than-expected estimates are due in large part to prospects for the

2012 crop. The USDA said in its report that crop planting and emergence is

early due to favorable weather. This means the harvest will start earlier than

normal, and the USDA said end-users will have earlier access to 2012 supplies

in August, before the end of the 2011-12 marketing year.” - “The USDA also projected a record crop, with a yield of 166 bushels per acre.”

- “The report was a shock to traders because cash market prices have soared

recently amid growing concern that some corn users may not be able to secure

supplies this summer.

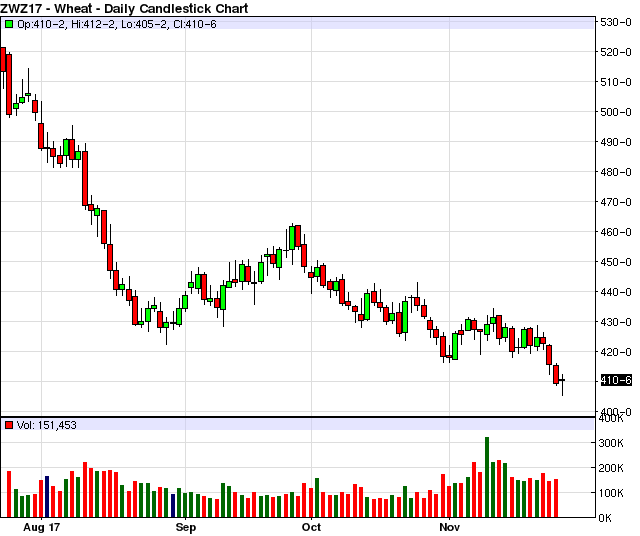

WHEAT

-From DOW JONES NEWSWIRE by Andrew Johnson Jr.

-

“Crop data issued by the U.S. Department of Agriculture are seen as negative

for wheat prices because they project U.S. supplies are not threatening.” -

“The USDA projects all wheat production at 2.245 billion bushels, above the

1.999 billion produced in 2011. All winter wheat production was pegged at 1.694

billion bushels, above the average analyst estimate surveyed by Dow Jones at

1.634 billion.” -

“U.S. hard red winter wheat is estimated at 1.032 billion bushels, up from 780

million in 2011, and soft red winter wheat production was pegged at 428

million.” -

“The USDA projects U.S. wheat inventories as of May 31 at 768 million bushels,

down from last month’s forecast. Inventories should then decline to 735 million

in the new crop year, which ends May 31, 2013, according to government

forecasters.” -

“Global ending stocks for the 2011-12 crop year are estimated at 197 million

metric tons, below the 206.3 million tons estimated last month.” -

“Meanwhile, weekly wheat export sales totaled 550,500 metric tons, including

221,600 metric tons for the current marketing year and 328,900 metric tons for

the year starting June 1, according to the USDA. The sales were within trader

expectations that ranged from 400,000 to 800,000 metric tons.”

What does this all mean? Ask a Zaner Group broker toll-free at (800) 621-1414 or direct at (312) 277-0050 or LiveChat.

For additional customizable charts and quotes visit Markethead.com for a FREE, no-obligation 30 day subscription.

Futures, options and forex trading is speculative in nature and involves substantial risk of loss. All known news and events have already been factored into the price of the underlying commodities discussed.

Pre USDA Report Thoughts (5/10)

Trading commodity futures and options involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge and financial resources.

By: Ted Seifried, senior broker at Zaner Group.

Pre USDA Report Thoughts (written 5/09)

The trade is mostly looking for a bearish USDA monthly report tomorrow. Grain markets reflect that as we have seen lower prices over the last week and a half. However, the average trade guesses are looking for large changes compared to last months report and I wonder how willing the USDA will be to make any wide scale changes this month. New crop supply is far from being determined and even acreage numbers will change dramatically from the USDA’s current estimates. Keep in mind that the USDA is most likely going to stick to their March 30 Planting Projections acreage estimates until they issue their own final plantings numbers on June 29. And, the USDA may choose to hold off for now on making any major changes to the old crop balance sheet as well for the sake of wanting to get a better handle on how far we will have to carry old crop supplies as an early harvest would take significant pressure off of old crop ending stocks.

So, if we do see an unchanged or a small change report tomorrow the likely knee jerk reaction will be that it is not as bearish as we have factored into the market and we could get a bullish reaction. But again, this would be based on the idea that we have spent the last week and a half pushing prices down in anticipation of a bearish report. However, it could be argued that good weather along with a record planting pace and a negative turn in outside markets were the real driving factors in the price decline and not the report. Ultimately, it looks like the dollar is poised to strengthen and it seems that speculators have been moving out of commodities with crude oil trading below $100 a barrel and gold under $1600 an oz for the first time in a while. Couple this with fast planting and good weather and it could be difficult to get a sustained rally at this time.

See December Corn Daily chart:

See November Soybean Daily chart:

This means that speculators should be looking for opportunities and producers need to make sure they lock up prices that makes sense for their bottom line. Give me a call for some ideas. In particular, producers looking to hedge all or a portion of their production may be rather interested in some of the strategies that I am currently using.

In my mind there has to be a balance. Neither technical nor fundamental analysis alone is enough to be consistent.

Please give me a call for a trade recommendation, and we can put together a trade strategy tailored to your needs.

Ted Seifried (321) 277-0113 or tseifried@zaner.com

Call Ted Seifried at (312) 277-0113

or e-mail him at tseifried@zaner.com

How to open an account with Zaner Group.

Additional charts, studies, and commentary can be found at Markethead.com.

Subscribe FREE to Zaner Group’s Daily Research Newsletter.

View my thoughts on other markets at Ted Seifried Futures Trading Strategies blog.

Futures, options and forex trading is speculative in nature and involves substantial risk of loss. All known news and events have already been factored into the price of the underlying commodities discussed.